In the ever-evolving landscape of digital transactions, businesses face the constant challenge of managing payments efficiently and securely. For Canadian businesses, the integration of Chargeback Protection, Automatic Billing, and Recurring Payments has become a crucial aspect of financial management. In this blog, we’ll delve into the significance of these key elements and explore how they contribute to a seamless and secure financial ecosystem in Canada.

Chargeback Protection: Safeguarding Transactions

Chargebacks can be a nightmare for businesses, leading to financial losses and potential damage to reputation. Chargeback Protection serves as a robust defense mechanism, providing businesses in Canada with a shield against fraudulent chargeback claims.

In the Canadian context, where e-commerce is thriving, Chargeback Protection becomes particularly vital. With the increasing prevalence of online transactions, the risk of chargebacks has also surged. Canadian businesses, both large and small, need reliable safeguards to protect their revenue streams.

Chargeback Protection systems leverage advanced algorithms and real-time monitoring to detect suspicious activities. These systems analyze transaction patterns, identify anomalies, and flag potentially fraudulent transactions for further investigation. By implementing Chargeback Protection businesses in Canada can minimize the impact of chargebacks, ensuring a more secure and stable financial environment.

Automatic Billing: Enhancing Efficiency in Payment Processes

Automatic Billing, also known as automated billing or recurring billing, revolutionizes the way businesses handle payments. In the Canadian market, where subscription-based services and memberships are prevalent, Automatic Billing emerges as a game-changer.

Businesses can set up Automatic Billing systems to automatically charge customers at regular intervals, whether monthly, quarterly, or annually. This not only streamlines the payment process but also ensures a steady and predictable revenue stream for businesses offering subscription services.

Canadian consumers, accustomed to the convenience of seamless transactions, appreciate the simplicity of Automatic Billing. Whether it’s for streaming services, software subscriptions, or utility bills, the automatic deduction of funds eliminates the need for manual intervention, reducing the risk of late payments and enhancing overall customer satisfaction.

Moreover, Automatic Billing systems in Canada adhere to stringent security protocols to protect sensitive financial information. With compliance to industry standards, businesses can instill trust among their customers, encouraging long-term relationships.

Recurring Payments: Fostering Customer Loyalty

Recurring Payments go hand in hand with Automatic Billing, contributing significantly to customer retention and loyalty. In the Canadian market, where consumer preferences are evolving, businesses need to adapt to the changing landscape to stay competitive.

Offering products or services through a recurring payment model not only provides a predictable revenue stream but also fosters a sense of loyalty among customers. The convenience of automatic renewals coupled with the assurance of regular access to desired services creates a win-win situation for both businesses and consumers.

In Canada, where consumers value convenience and personalized experiences, businesses can leverage Recurring Payments to tailor offerings to individual preferences. This customization enhances the overall customer experience, making it more likely for customers to stick with a particular service or product over the long term.

The Synergy of Chargeback Protection, Automatic Billing, and Recurring Payments

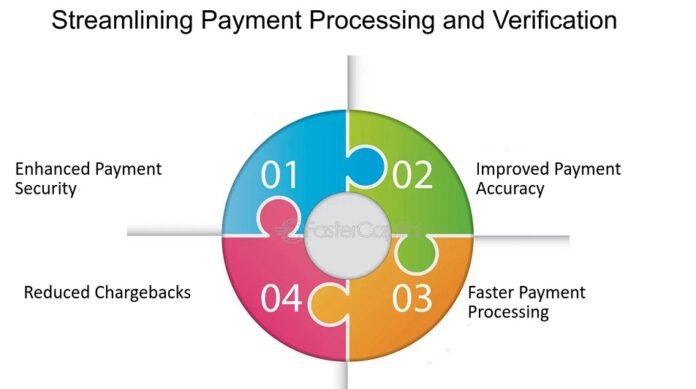

While each of these elements—Chargeback Protection, Automatic Billing, and Recurring Payments—plays a distinct role in the financial ecosystem, their synergy is what truly transforms the landscape for businesses in Canada.

Imagine a scenario where a Canadian e-commerce platform employs Chargeback Protection to detect and prevent fraudulent transactions. Simultaneously, the platform utilizes Automatic Billing to seamlessly collect payments for monthly subscriptions, and Recurring Payments ensure that customers continue to receive the services they love without interruption.

This seamless integration not only enhances the efficiency of financial transactions but also fortifies the financial health of businesses. It mitigates risks associated with chargebacks, optimizes revenue collection, and solidifies customer relationships through the reliability of recurring services.

Conclusion: Navigating the Future of Canadian Transactions

In conclusion, the convergence of Chargeback Protection, Automatic Billing, and Recurring Payments paints a promising picture for businesses navigating the dynamic landscape of financial transactions in Canada. As technology continues to advance, businesses that embrace these elements stand to gain a competitive edge by offering secure, efficient, and customer-friendly payment solutions.

For Canadian businesses looking to thrive in the digital era, the adoption of these financial tools is not just an option but a strategic imperative. By prioritizing the security of transactions, streamlining payment processes, and fostering customer loyalty, businesses can pave the way for sustained success in the evolving Canadian marketplace.

In the rapidly evolving Canadian business landscape, the integration of Chargeback Protection, Automatic Billing, and Recurring Payments isn’t just a modernization of financial processes—it’s a strategic investment. As consumers demand seamless experiences and businesses navigate the complexities of online transactions, these tools become essential pillars, ensuring not just financial efficiency but also building a foundation for enduring customer trust and loyalty in the ever-changing world of commerce.