If you have credit issues, you know the difficulties they can cause. You could only be approved for a credit card or auto loan with a high credit score. It can make finding an apartment challenging. Therefore, an advertisement offering to help you rebuild your credit history by obtaining a CPN could solve all your problems.

The format of a credit privacy number (CPN), which consists of nine digits, is identical to that of a Social Security number (SSN). Other names for it include credit profile number and credit protection number. Companies that sell CPNs to consumers promote them as a solution to cover up a bankruptcy or a poor credit history. They will also assert that when applying for credit under your new credit identity, you can utilize your CPN rather than your SSN.

- Do CPNs Help with Bad Credit?

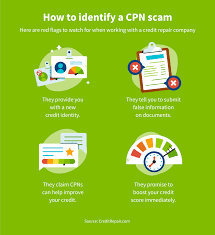

Companies that offer CPNs promote the assumption that CPNs are authentic by marketing them as substitutes for SSNs. If you pay attention, there are several indicators that CPN dealers are participating in illegal activity. While SSNs are provided without charge, organizations will charge you money, sometimes hundreds of dollars, for a CPN. When you apply for cpn with 700 credit score, they could advise you to use incorrect information, like a different address, phone number, or email address.

Frequently, they will claim that doing this will safeguard your identity, but they aretelling you to take on a phony persona.It is simple to dismiss these cautionary signs when you are desperate to restore your credit.

However, a CPN might result in far more severe issues than a bad credit rating. Using the CPN in a credit application or elsewhere may be considered identity theft regardless of how it was acquired. Furthermore, it is illegal under the federal government to falsify your SSN or lie on a credit or loan application.

- How to Correctly Rebuild your Credit

By acquiring a CPN, poor credit cannot be erased fast. An improved strategy is to use the money you would have spent on a CPN scam to restore your credit history correctly. Here is how:

The single most significant element affecting your credit score is on-time payments. Paying your bills on time will assist, even if you can only afford the minimal amounts. Set a reminder or enable autopay on your accounts to prevent forgetting to pay a bill on time. Ask the creditor if you can modify your due date if you find it difficult to pay all your bills simultaneously since they are all due around the same time. Your credit usage ratio should be lower.

In determining your credit score, this ratio, which comes in second only to payment history, reveals how much of your available credit you are utilizing. You should utilize at most 30% of your available credit to maintain decent credit but think in single digits for the most outstanding scores.

- Postpone Requesting Credit

A hard inquiry is made on your credit report when a lender requests your credit file from one or more credit agencies in response to your application for a loan, credit card, or another sort of revolving credit. The number of complicated queries lowers your credit score.

Applying for numerous credit cards or loans at once may indicate to credit scoring models that you are in financial problems, which might lower your credit score even though the drop typically only lasts a few months.

- Keep Outdated Credit Cards Active

If using credit cards drains your finances, cancelling the account after using one is a wise approach to reduce temptation. However, doing so also lowers the overall amount of available credit, often raising your credit usage ratio. Maintaining older accounts open also demonstrates your extended credit history, which raises your credit score. Maintaining older credit accounts active may be a good idea, even if you do not intend to use them.

Be careful of any company that promises quick credit improvements, especially CPN scams. Identity theft may be involved if someone uses a cpn with 700 credit score to construct a false identity to qualify for credit.